Sales is the lifeblood of a company, and there’s always pressure to know how sales is performing. Revenue, activity, forecast … management always wants to know what is going on. And the answer is often more data and more metrics. Letting the data speak to you can make the key difference for your sales team & organiztion, and there are many different data collection methods you can select depending on your organization’s needs. As for metrics, we’ve tried listing the key indicators for a sales team, on an employee-level as well as for the sales manager and on the company-level. In this extensive list (long article ahead, take your time through!), we hope you find the ones that really matter for you and your business.

Table of Content

Individual Sales Metrics

1. Activity Sales Metrics

Activity sales metrics are there to show how busy salespeople are and what they are doing on a daily basis. They are a direct indicator and can be tracked by sales managers to help them manage the members of their sales team.

If a rep isn’t hitting her quota, a sales manager can dive deeper into her metrics and discover she isn’t sending enough emails or calls to generate the number of meetings she needs. Telling this rep to increase her sales is too broad, but telling her to increase her daily email or to dial more can have an impact.

Activity metrics include:

- Number of calls made

- Number of emails sent

- Number of conversations

- Number of social media interactions

- Number of meetings scheduled

- Number of demos or sales presentations

- Number of referral requests

- Number of proposals sent

Activity sales metrics are leading indicators. Making X calls that convert Y% to customers can help make forecasts.

2. Sales KPIs by role

Nowadays, in large sales teams, there are plenty of sales roles and each role has different priorities. An Inside Sales’ performance will not be measured the same way as an SDR.

Inside Sales KPIs

The first to be in contact with leads, inside sales teams rely on these KPIs (from most frequently used to least):

- Number of meetings booked

- Number of deals closed

- Opportunities by stage

- Lead Response Time

- Calls

- Emails

- Meetings / Demos

- Significant interactions or events (lasting conversations)

- Opportunities created

- Quotes/proposals

Field Sales KPIs

Outside sales teams, frequently on the move, use many of the same metrics as inside sales teams but prioritize meetings more heavily.

- Meetings

- Number of deals closed

- Opportunities created

- Opportunities by stage

- Quotes/proposals

- Significant interactions or events

- Calls

- Demos

- Emails

Sales Development Metrics

Companies measure SDR activity with metrics further into the sales pipeline such as meetings, opportunities… and how they grow their pipeline.

- Meetings

- Calls

- Opportunities created

- Significant interactions or events

- Opportunities by stage

- Number of deals closed (by their partner Account Executive)

- Demos

- Emails

- Meetings scheduled

Account Executive Metrics

Account Executives are the main point of contact for sales and coordinate the sales team for an account.

- Numbers of deals closed

- Meetings/Demos

- Opportunities by stage

- Quotes / Proposals

- Calls

- Significant interactions or events

Business Indicators

These metrics are general business indicators and give an idea on how the sales team impacts the business at the company-level.

- Total revenue

- Percentage of revenue from new business

- Percentage of revenue from existing customers (cross-selling, upselling, repeat orders, expanded contracts, etc.)

- Year-over-year growth

- Monthly Sales Growth

- Number of deals lost to competition

- Average Profit margin

- Cost of selling as a percentage of revenue generated

1. Revenue

At the end of the day, revenue is the most important KPI for sales teams. But while gross income might seem like a relatively simple metrics — it’s simply how much money you make during a specific time frame, including discounts and returned/canceled products/services — there are some subtleties.

For a subscription business, typically a SaaS company, revenue is tracked as monthly recurring revenue (MRR), or the total amount of revenue you expect to receive each month, and annual recurring revenue (ARR), the total amount of predictable revenue you receive each year.

If you have 2,000 customers, and the average amount paid per month for an account is $50, a metric called ARPA, your MRR is $100K (2,000×50) and ARR is $1,200K (or $100k x 12)

Of course, as a sales leader, it’s always a good idea to compare your revenue to previous years. Year-on-Year growth tells you how you are doing compared to the previous year.

You can also dive deeper into your revenue and break it down to see:

- Percentage of new businesses (customers who have never bought anything from your company before)

- Percentage of upsell/cross-sell/expansion (existing customers who are buying another product or upgrading to a higher tier or package)

- Percentage of renewal (customers who are extending their contract for another month, six months, year, etc.)

You can also break down your revenue by region/country, product line.

2. Monthly Sales Growth

If your business isn’t growing, it’s dying.

That’s even more the case for start-ups. For new companies, looking at annual sales revenue is often too far of a projection and the variation can be huge from month to month as the sales team ramps up. This is why measuring the increase or decrease in sales revenue on a monthly basis is a good thing. It allows sales managers to react to sudden changes or trends, as they’re happening rather than looking at the bottom line at year’s end. Using monthly sales growth as a sales KPI gives sales managers actionable insights they can use to optimize sales processes, strategies or team size.

Meanwhile for sales reps, looking at monthly revenue growth can inspire performance and keep sales efforts aligned, especially if you incentivize them with commission or rewards according to performance. Setting attainable sales revenue goals both on an individual and team basis can inspire performance and keep sales efforts aligned.

3. Average Profit Margin

When your company has a large offering of products and services, this KPI can help the sales team know where to focus their efforts. It can be especially effective to deliberately allow sales reps flexibility in pricing to lock in customers.

KPIs for Sales Managers

Team Management

1. Sales Target or Monthly Sales Bookings

The total monthly “won deals” as determined by either a closed deal or a committed sale. Sales Target compares sales wins over periods of time. This sales KPI is what drives most sales teams, and it can be split out into a variety of ways, same as revenue —such as per region or per employee. This KPI can be helpful in establishing a sales baseline, help define personal goals and detect the strengths and weaknesses of each rep.

Keep in mind that some sales are better suited to handle a smaller number of big deals, others prefer handling a lot of smaller ones. It’s also always a good idea to compare both the number of sales and the sales revenue for each sales rep.

Strike for balance. Unreachable targets will demotivate your sales team and lead to burnout. Looking at past performance and setting ambitious yet attainable goals is the pathway to success.

Focusing only on sales per rep can lead to an overly competitive culture, where sales reps compare their performance to each other. It might be a boost in the short term in terms of revenue, but think of long term consequences to your sales team.

2. Percentage of Sales Team Hitting Quota

From revenue goals, it’s easy to define quota per sale. Quota attainment, or the percentage of salespeople meeting or exceeding quota, tells you whether your quotas are too ambitious or low. As a rule of thumb, aim for 60% attainment rate on your quotas.

On one hand, less than 60% tends to mean your targets are unrealistic. It could also mean that your sales process is not up to par or that you need to hire better salespeople and/or let go of the underperformers. If that doesn’t cut it, it could mean your sales team isn’t properly incentivized. Rethink your sales compensation plan and motivational strategy.

On the flip side, if 90% to 100% of your salespeople are hitting their quota, they’re probably coasting and feeling pretty good about themselves. With such high numbers, you can definitely think of higher goals.

3. Average Deal Size

Your average deal size is calculated by dividing your total dollar amount of deals by the total number of those deals. This measures the average value of each opportunity and therefore helps the sales team place a quantifiable value on each potential opportunity. This helps sales reps know which deal to focus on. This is how a sales team can estimate the true dollar value of each lead.

Look at this metric on a monthly or quarterly basis to know whether your deals are getting larger, smaller, or flat. If you’re trying to move upmarket, obviously you’d want the average deal size to increase. If your audience is closer to SMBs, this number should go down but at the same time, your number of new customers should go up, for your overall revenue to increase.

Average deal size is a way to spot potentially touchy deals. If a big opportunity comes up, four times larger than normal, then your average deal size will increase. But that also means it’s a more complex deal, so the probability of closing is lower, sales processes will take longer. A big deal can be a lifesaver for a sales rep’s quota, but that also means putting a lot of their quota eggs in one basket, which in turn could hurt your sales team’s quota.

The average deal size can also be a big help to single out low performers. Salespeople with an average deal size lower than the team’s average are maybe looking to go after the low-hanging fruit to increase their conversion rate. Another option could be that they are discounting too aggressively and that hampers their own performance. In any case, it’s valuable information.

4. Sales Opportunities

Sales teams need to have an idea of their pipeline’s worth. Attributing a value and a probability to all pending opportunities, allows the sales teams to focus their resources on the leads most worth their efforts.

Leads can, therefore, be ranked according to the likelihood of closing, assuming enough data has been collected by the sales team. Data such as timing, budget or being in contact with the decision-maker allows sales teams to know what makes for a probable close.

5. Sales Closing Ratio

This KPI finds the ratio between how many quotes your sales team sent out and how many deals they closed.

It’s a great KPI for determining how much time a sales employee (or the overall team) spends on pursuing an opportunity.

A high Sales Closing Ratio signals that either the leads coming in are not quality leads and/or that the sales team is spending far too much time trying to close each deal.

6. Conversion Rate or Win Rate

Your conversion rate or win rate measures the percentage of leads that ultimately become customers. If you get approximately 500 leads per month, and on average 50 buy your product/service, your conversion rate is 10%. You can calculate your conversion rate at multiple stages such as how many leads closed out of all leads, how many demos closed, etc.

This metric can help you calculate how many leads you need in order to make your revenue targets. For example, if your monthly sales target is $800,000, and your average deal size is $1,000, your salespeople need to close 800 deals. And if your conversion rate is 20% of your leads become customers, you need 4,000 leads per month.

Historical conversion rates is a valuable metric to understand whether your reps are becoming better performers. If average win rate is climbing — provided the number of leads stays the same or increases — then sales performance is improving.

But if conversion rate is dropping — while the quantity of deals is flat or decreasing — something needs to be tuned in your process, team, and/or lead generation efforts.

If you switch from one market to another, from SMBs to mid-market businesses for instance, expect a temporary drop in conversion while your sales team adjusts.

Don’t always rely on one metric for big decisions. If one percentage grows, the others will naturally tend to lessen but it doesn’t necessarily mean your overall revenue is dropping.

Sales Pipeline Metrics

Sales team metrics are important but the value of your pipeline helps you understand what’s working in your sales process. Here’s a shortlist of pipeline metrics to keep track of.

- Average length of sales cycle

- Time spent in each stage of the pipeline

- Conversion rate by sales funnel stage (by team and by individual)

- Sales funnel leakage

- Number of contact points

1. Sales Cycle Length or Average Days to Close

Business takes time and time is money. When comparing conversion rates of marketing campaigns, you must take into account sales cycle length. Results might come in after 3 weeks or a month.

It’s important as well for sales reps. Some reps manage to close in three weeks while others take closer to six? Six months on, are they still customers? Do they have the same churn rates from onboarding? A longer sales cycle might yield a healthier business.

Analyze what sales cycle length produces the highest number of closed-won business. And measure their churn rate afterwards to see how successful those deals are down the line.

2. Time Spent in Each Stage of the Pipeline

Knowing the time spent at each stage of the pipeline will reveal how your leads are working their way through your sales pipeline and, possibly, where the pipeline clogs.

Using this metric, you can isolate the problem. Are your inside sales struggling to book demos or meetings? Are your salespeople struggling with leads in the ‘To Demo’ stage? This KPI will help you know where to focus your efforts.

By being certain with the position of your prospects, you’ll be able to assess more accurately which stage of the pipeline your prospects are sitting.

Make sure that your sales staging is based on what is actually happening, not on how sales reps feel. A sales rep can be confident to close, but if the deal stayed for 2 weeks in the same stage, that might not bode well.

3. Sales Funnel Leakage

Directly influenced by the previous metric, measuring sales funnel leakage tells you where leads drop out of your funnel at the greatest rates. Leakage is where your leads give up.

To determine your leaky points, track stage-by-stage conversion rates. For instance, say 50% of new leads agree to a first call. Half of those make it to the meeting or demo stage and just 5% end up buying. That steep drop-off indicates your salespeople are likely, A) not qualifying enough, you are losing half your leads at the first stage, B) giving bad demos, and/or C) are poor at negotiating. Knowing these potential issues, you can observe them more closely to determine where help is needed.

By finding and improving these weak points, you can dramatically improve results.

4. System Touches

Ideally, you’d like your sales process to be as “low touch” as possible, meaning your salespeople are closing new business and leads move smoothly from one stage to the next.

If you review a salesperson’s quarterly or monthly numbers and see that they missed their quota and had a very high number of touchpoints per closed-lost deals (say, five video meetings, 11 emails, and seven phone calls), it might be time to rethink their technique and strategy. They are either wasting time focusing on poor leads, or planning too much activities for the leads they have and not moving their leads to the next stage fast enough.

Analyze your most successful reps’ average touchpoints. It probably means they are not wasting time and picking the right amount of touchpoints to be most effective. Ask these reps to share their strategies, techniques, and advice to streamline your team’s average, collective sales cycle.

There is no single metric of truth. And while data speaks, it doesn’t get you the whole picture. Based on the insights, analyze the information, talk with your team and determine how performance can be improved with follow-up actions. Keep your goals in sight and success will follow.

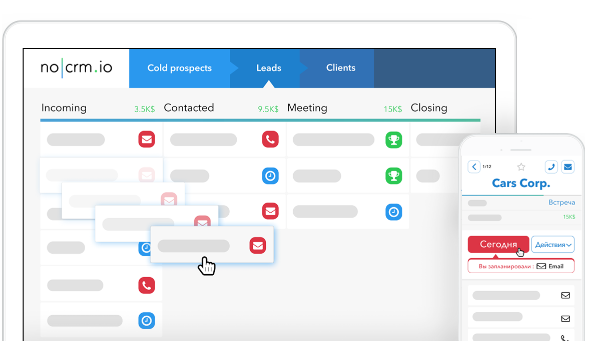

A tool like noCRM already provides a lot of metrics and can help you identify the pain points that your sales teams face and bring quick actions to fix it. For reference, you can take a look at our help center where we go in further details on the metrics available to you in noCRM. You can also start a free trial of the Expert Edition and see for yourself all reporting features.